Leveling Up in India: Why Global Gaming Platforms Struggle With Payments And How to Fix It

Published on: Sat 19-Apr-2025 08:22 AM

India is now one of the top five gaming markets in the world, with over 500 million players and an expanding mobile-first audience. But for global gaming platforms, monetizing this massive user base isn’t easy — not because of demand, but due to deep-rooted payment and revenue infrastructure challenges.

Whether you're selling skins, gems, in-app currency, subscriptions, or VIP passes, here’s why India remains a tough level to beat — and how you can finally break through.

1. Indian Gamers Don’t Use Cards — They Use UPI and Wallets

In Tier 1 cities, cards are limited. In Tier 2 and Tier 3 cities, they’re almost nonexistent.

Less than 0.5% of Indian gamers own a credit card (Economic Times)

But over 80% of transactions happen via UPI (Reuters)

Most global gaming platforms use Visa, Mastercard, or PayPal — and completely miss the local checkout stack:

What Indian gamers want:

UPI (PhonePe, Google Pay, Paytm)

Mobile wallets

Netbanking

Local debit cards like RuPay

If your payment gateway doesn’t support these, expect drop-offs, abandoned top-ups, and low conversion rates.

See how Transact Bridge helps global gaming platforms accept UPI instantly

2. Tokenization is Breaking In-App Purchases

India’s RBI tokenization mandate changed how card details are handled — and global platforms are still catching up.

Example:

A gamer tries to top-up diamonds or coins using a saved card.

Instead of a seamless flow, the token takes too long to generate or fails completely.

Common pain points:

Timeout errors on payment pages

Only 8–10 tokenized transactions per second

Refund failures (especially on guest checkouts)

Chargeback chaos, with no real resolution for digital goods

Read: Why merchants are struggling under India’s tokenization rules — Medianama

For platforms with in-app stores, loot boxes, or live gifting, this means serious revenue loss.

3. No Recurring Payments = No Battle Pass Renewals

India’s RBI also enforces Additional Factor Authentication (AFA) — which breaks recurring payments.

Players can’t auto-renew Battle Passes, seasonal packs, or VIP access

Most payments fail unless manually re-approved every month

Gamers churn due to failed renewals and poor user experience

Case: Spotify faced a similar challenge — many Indian users were downgraded from Premium because recurring payments failed under new RBI norms

Spotify India Payment Issue – Official Support Page

Solution: Transact Bridge enables UPI AutoPay and recurring debit mandates — no card needed, no compliance friction.

4. Low Checkout Success = High Drop-off Rates

Gaming monetization relies on speed, trust, and impulse. If your payment flow lags or errors out, you lose the moment.

Transact Bridge has observed:

Many global gaming platforms face <50% success rates with non-local gateways

Users bounce if the checkout redirects or fails

Refunds & chargebacks become messy — and irreversible for virtual goods

🛠️ Transact Bridge’s Smart Routing Engine dynamically sends each transaction to the best-performing local acquirer — ensuring better success rates across UPI, cards, and wallets.

5. Gaming Creators Also Face Payment Barriers

It’s not just platforms — Indian gaming streamers, content creators, and influencers face trouble too.

Payout delays due to lack of FEMA/RBI-compliant fund repatriation

Withholding tax issues

High drop-offs during in-app gifting or tipping

Whether you're running a platform like Twitch, Codashop, Free Fire, or YouTube Gaming, you need an infrastructure that works for both gamers and creators.

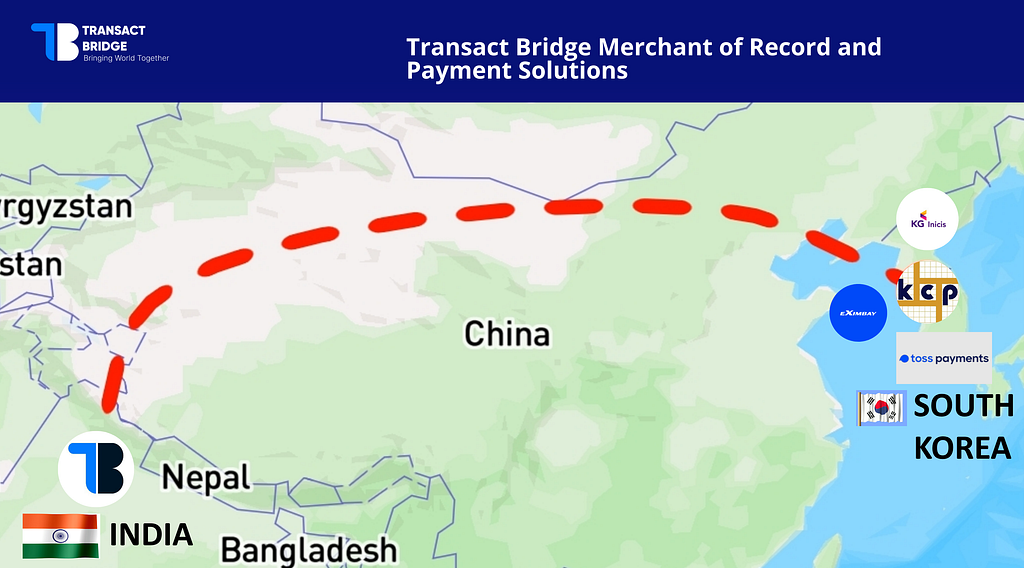

How Transact Bridge Solves This for Global Gaming Brands

Transact Bridge is a Merchant of Record (MoR) built for global platforms targeting India — handling taxes, payments, compliance, and repatriation.

Why Gaming Companies Use Transact Bridge:

- Accept UPI, RuPay, wallets, netbanking — all with one integration

- UPI AutoPay for battle passes, monthly packs, and recurring top-ups

- Smart routing with 10+ local acquirers = high success rates

- We handle GST, refunds, disputes, chargebacks

- RBI-cleared fund repatriation to your home country

- No need for an Indian entity or local registration

- Customizable checkout flows that look & feel native to Indian gamers

- GST-compliant invoicing — automated and localized

Ready to Enter India’s $3B+ Gaming Market Without the Pain?

Book a Demo to see how we help global gaming platforms unlock India’s full monetization potential.