Empowering Global Businesses in India as Leading MOR solution for Indian market.

We are the best Merchant of Record (MoR) solutions provider for global companies in India, which enables businesses to navigate the complex Indian market with confidence. 1000+ SaaS, AI and live chat apps businesses use Transact Bridge to solve all their payments, tax and compliance needs. Because the world needs MoR in India. Whether you’re e-commerce, gaming, or any other digital products, our solutions allow you to leverage popular Indian payment methods like UPI, Netbanking, Paytm, PhonePe and cards. Partner with us to streamline your operations and unlock new opportunities in India’s dynamic economy

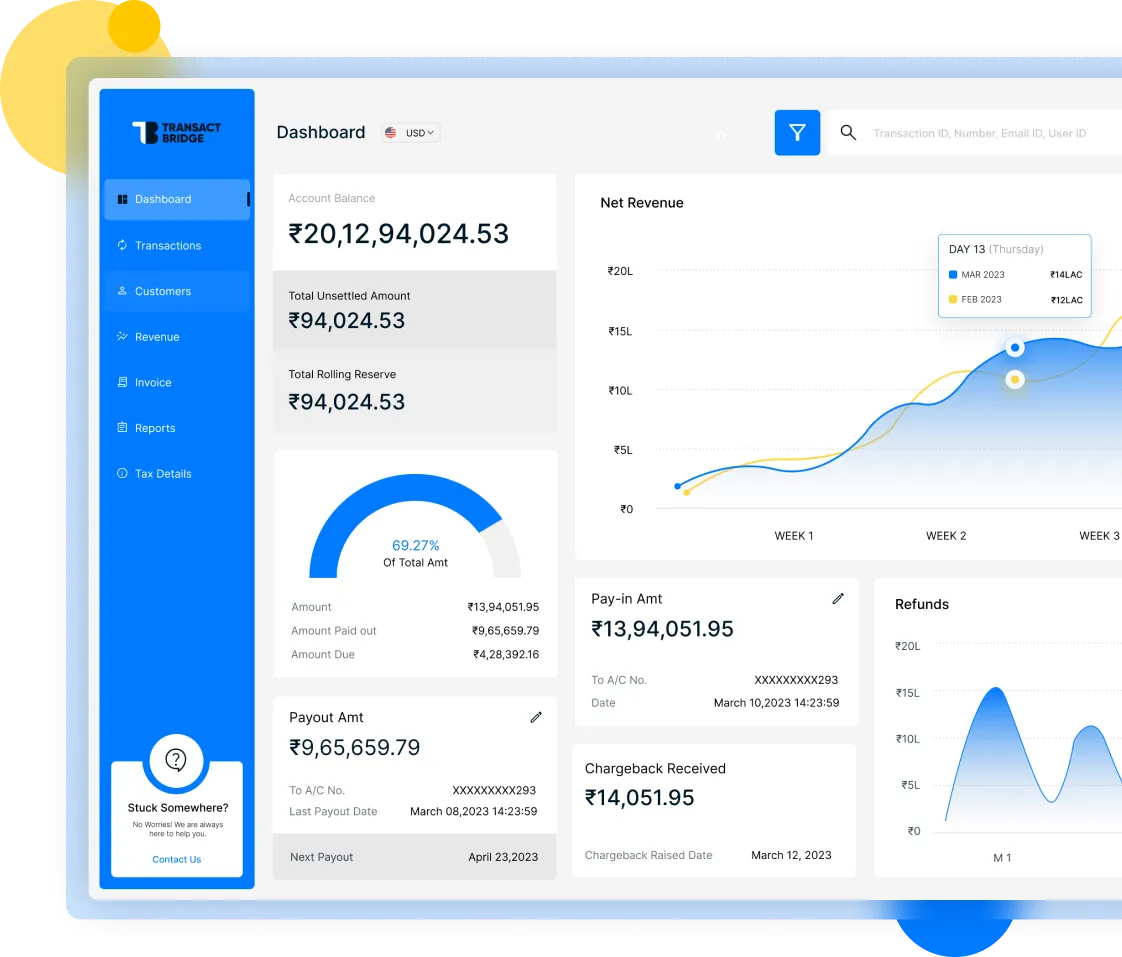

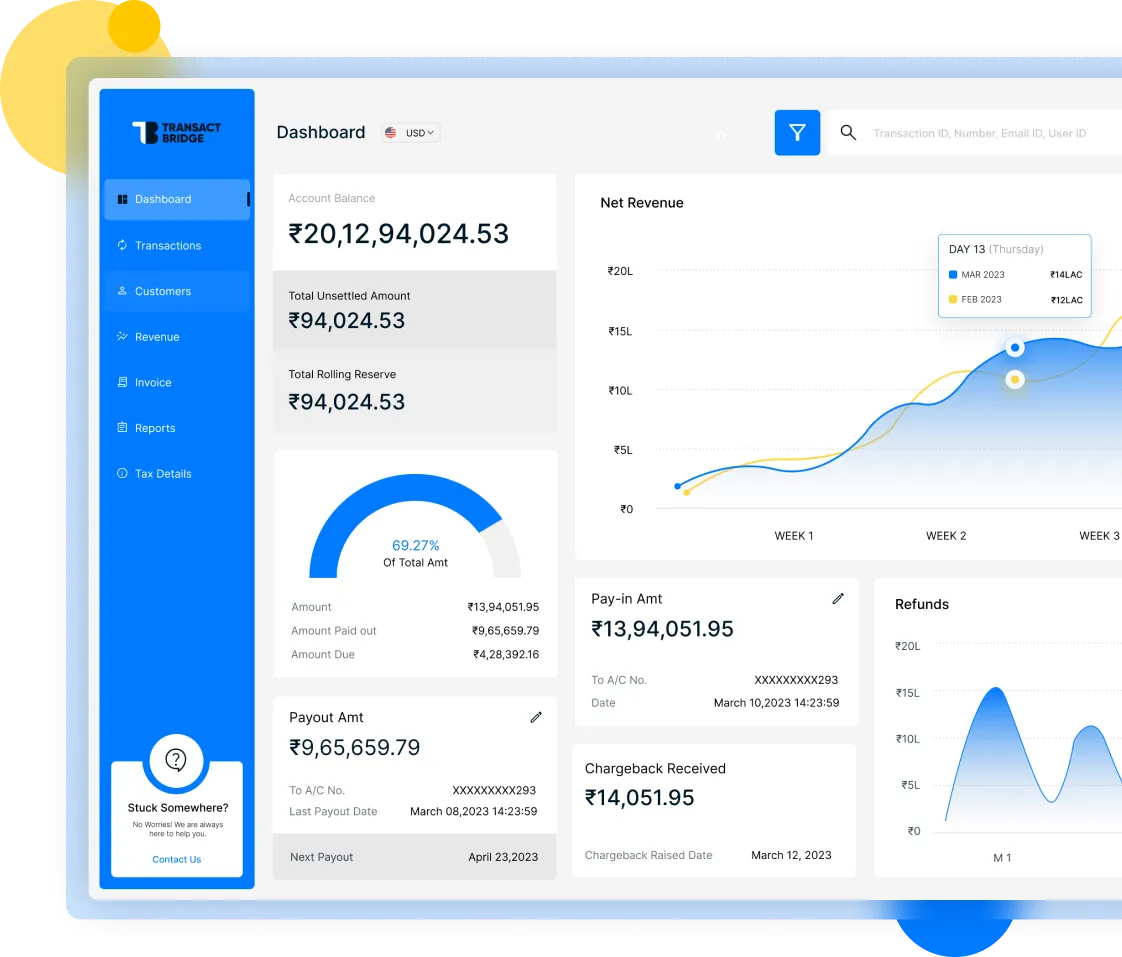

Our Product

Help you to enter in India market

Invoice & Billing

Automates invoicing and billing with branded invoices, tax calculations, multiple payment options, real-time tracking, and automated reminders for seamless cash flow management.

Risk Management & Chargeback

AI-driven fraud prevention detects risks, blocks high-risk transactions, and ensures compliance. Real-time monitoring, risk flags, and dynamic blocking enhance security and prevent chargebacks.

Smarter Checkout

Enhance trust with a seamless, branded payment experience. Customize checkout pages, invoices, and payment links for consistent branding.

Zero-Code API Integration

Collect payments effortlessly without coding. Our no-code API solution enables seamless setup, allowing businesses to connect and manage transactions with ease.

Cross-Border Success, Engineered for India

From Payments to Compliances — Where Intelligence Powers Global Expansion

750%+ Revenue Growth

Break into India’s $1T+ Digital Economy

"Transact Bridge empowers international brands to unlock hyper-growth by eliminating local setup delays, minimizing compliance risks, and accelerating revenue with our fully managed Merchant of Record model"

99.5% Transaction Clearance Rate

Highest Payment Success Rate Across Indian Gateways

"Our smart routing engine, backed by local acquiring networks and AI-driven retry logic, ensures that global merchants avoid friction, minimize declines, and maximize acceptance."

100% Regulatory Compliance

India-Ready, Audit-Ready — Always

"Whether it’s GST, FEMA, RBI reporting, or TDS filings — Transact Bridge owns the compliance lifecycle. You stay expansion-focused while we keep your operations legally secure."

99.8% Recurring Payment Stability

Optimized for Subscriptions, SaaS, and Digital Products

"We ensure continuity in recurring billing with auto-renewal workflows, smart retries, and robust compliance — reducing churn and increasing LTV across Indian customers."

Expand into India Without Borders

Accept Payments Like a Local - With Global-Grade Infrastructure

Seamless Checkout. Maximum Reach.

Let your customers in India pay the way they prefer. Transact Bridge supports every major Indian payment rail, from UPI and RuPay to credit cards, wallets, and net banking — all on a single, secure checkout.

BUILT FOR GROWTH-FOCUSED COMPANIES

The Smartest Way to Enter and Scale in India

Global Ambition. Local Execution.

We go beyond payments - Transact Bridge simplifies your entire go-to-market motion for India. From seamless FX to regulatory compliance, we provide the local infrastructure global businesses need to grow fast and stay compliant.

What We Power for You

Power Recurring Payments That Just Work

Own the Customer Experience with Automated Mandates

INTEGRATION

One API. All Indian Payments. Plug and Play.

Integrate Indian payments in hours, not weeks. Our single API connects you to cards, UPI, net banking, and wallets — with smart routing, compliance, and real-time reporting built in. No local entity or technical effort needed.

OUR SERVICES

Tailored Payment Solutions for Every Industry

SAAS

CRMs, ERPs, web hosting, LMS, and bundled services - all supported with recurring and usage-based billing.

E-Commerce

Enable fast checkouts for fashion, electronics, supplements, edibles, and more.

DIGITAL PLATFORMS

Monetize content like music, live chat, live streaming, social chat apps, direct top up/voucher merchants, Digital products, themes, NFTs, eBooks, and software with seamless digital payment flows.

Gaming

Power in-game purchases, credits, digital assets, characters, and subscriptions at scale.