Recurring & Subscription Payments for India — Simplified. Merchant of Record + UPI Autopay in One Platform.

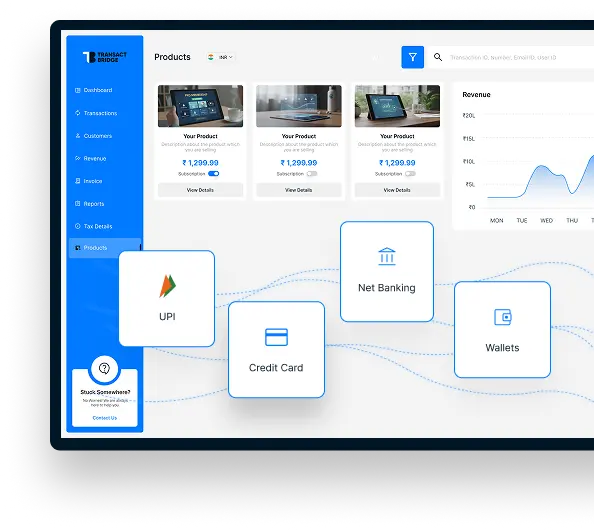

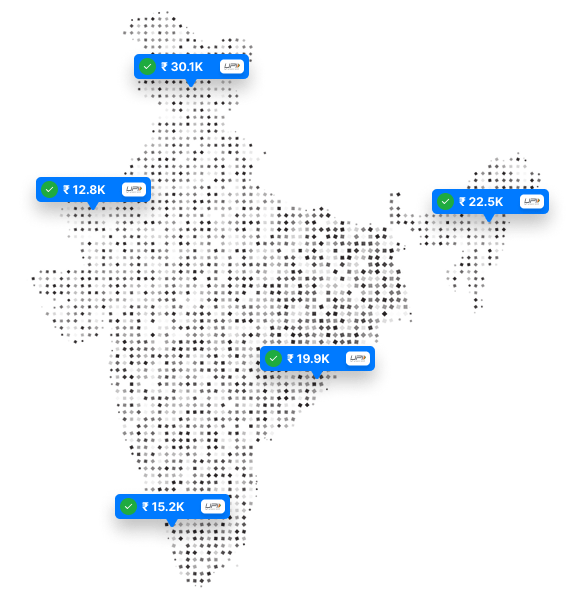

Transact Bridge helps global SaaS, OTT, D2C, Gaming and AI companies launch in India with fully-compliant recurring billing, automated invoicing, UPI Autopay, tax management, and subscription lifecycle automation.

Merchant of Record for India

UPI Autopay + Local Payment Methods

Enterprise-Grade Compliance & Reporting

Fast Go-Live for Global Companies

Flexible Billing Models

Built for Scale

Merchant of Record for India

UPI Autopay + Local Payment Methods

Enterprise-Grade Compliance & Reporting

Fast Go-Live for Global Companies

Flexible Billing Models

Built for Scale

Your Fastest Path to Subscription Revenue in India.

A fully managed MoR infrastructure built specifically for global-first companies expanding into the world’s fastest-growing digital market.

check_small Local Compliance Handled - GST, invoicing, KYC, MDR rules, RBI guidelines.

check_small UPI Autopay Support – Offer India’s most preferred recurring payment mode.

check_small Multi-method Billing –Cards, UPI, wallets, netbanking.

check_small 1–2 Week Integration – Developer-friendly APIs and ready workflows.

Everything You Need for Subscription Success in India.

Recurring Billing Engine

-

Multiple billing models: fixed, metered, usage-based, hybrid

-

Custom plan cycles (weekly, monthly, annual)

-

Trials, proration, one-time add-ons

Automated Invoicing & Taxes

- GST-ready invoices

- Automated tax calculation

- Local currency invoicing

- Downloadable invoice history

Smart Retries & Revenue Recovery

- Automated retries based on RBI payment windows

- Intelligent recovery workflows

- Dunning emails & notifications

Subscription Lifecycle Management

- Upgrades, downgrades, pauses, cancellations

- Smart proration

- Customer self-service portal

Developer-First API

- Webhooks

- Clean REST API

- Plan creation, subscription creation, invoices, payment actions

- Sandbox environment for testing

Analytics & Insights

- MRR & ARR dashboards

- Churn tracking

- Payment method performance

- Cohort analysis

UPI Autopay Integration

- Instant mandate creation

- Higher conversion than cards

- Support for all major UPI apps (Google Pay, PhonePe, Paytm)

Book a demo today!

Let’s find the perfect subscription solution for World’s one of biggest consumer market.

We Handle Compliance. You Focus on Growth.

RBI & Local Payment Compliance Handled

GST, Invoice, & Tax Management Included

Cross-border complexities removed

Chargeback & dispute handling

Regulatory audits & reporting managed

One contract → Sell legally in India

A Payment Platform for Every Type of EdTech.

-

SaaS Platforms

-

EdTech & Online Learning

-

OTT & Streaming Apps

-

Gaming & In-Game Purchases

-

Social Chat & Live Streaming Apps

-

D2C Brands with Subscription Products

-

AI Tools & Productivity Software

Onboard. Integrate. Start Collecting Payments.

Getting started with Transact Bridge is easy

Simple & Transparent Pricing

Flexible MoR-based pricing designed for global companies entering India. No hidden fees. No cross-border surprises.

Built for Developers. Designed for Scale.

check_small REST APIs

check_small Webhooks for payment events

check_small Sample integration codes

check_small Sandbox mode

check_small Developer Docs [Documentation]

Bank-Grade Security. Global Standards.

GLOBAL PAYMENT SOLUTIONS

Start Growing Subscription Revenue in India.

Launch with UPI Autopay, full MoR compliance, and enterprise-grade subscription billing — all in one platform.

Some Frequently Asked Questions.

-

What is Transact Bridge’s Recurring & Subscription Payment Solution?

It’s a complete subscription billing and Merchant of Record (MoR) platform that helps global companies sell in India using UPI Autopay and other local payment methods—without needing an Indian legal entity.

-

How does the Merchant of Record model help global companies?

Transact Bridge becomes the legal seller in India on your behalf. We handle compliance, GST invoices, taxes, payment regulation, chargebacks, and reporting so you can operate in India instantly and focus only on your product.

-

Do you support UPI Autopay for recurring payments?

Yes. Customers can create a UPI mandate once, and renewals happen automatically. UPI Autopay delivers higher success rates, faster activation, and wider coverage across major apps like Google Pay, PhonePe, and Paytm

-

What billing models can I offer?

You can offer fixed subscriptions, usage-based billing, trials, hybrid plans, one-time charges, and upgrades or downgrades with automatic proration. anking, wallets, and international-to-INR conversion for global EdTech.

-

Is the platform compliant with RBI and GST regulations?

Yes. We manage all required payment compliance, GST calculation, automated invoicing, record-keeping, and audit-ready reporting as part of the MoR service.

-

How long does it take to integrate?

Most global companies go live in 1–2 weeks using our developer-friendly APIs, hosted checkout, or no-code subscription flows.

-

What types of businesses is this solution ideal for?

It’s designed for global SaaS platforms, EdTech, OTT, D2C brands, gaming and in-app purchases, live-streaming apps, social apps, and AI tools expanding into the Indian market.