Launch in India with One Checkout. No Entity, No Headaches

Sell to Indian customers via UPI, cards, wallets & net banking — with a fully localized checkout, built for scale.

Why Checkout by Transact Bridge?

Go Live Without an Indian Entity

No company registration, no local bank account — we handle it for you.

Local Payments, Global Settlements

Accept in INR, get paid in USD or EUR.

One-Time & Recurring Billing

Ideal for SaaS, subscriptions, digital goods, and gaming.

Optimized for Conversion

Smart retry logic, branded UX, and blazing-fast load times.

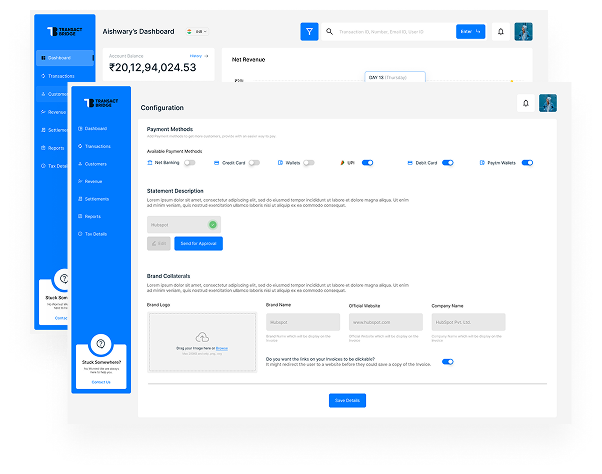

Make Checkout Feel Like Your Product

Create a seamless journey → From product to payment → Without sacrificing trust.

India’s Most Popular Payment Methods — One Integration

-

UPI

-

Debit Card/Credit Card

-

Net

Banking

Net

Banking

-

E-wallet Payments

-

EMI & BNPL (coming soon)

How Checkout Handles Everything for You

All-in-One Checkout Built for Growth

Local currency & language support

Sell seamlessly in INR with localized storefronts for Indian buyers

Automated GST handling & tax invoicing

Stay compliant with effortless tax calculation and invoicing.

PCI DSS v4 + ISO 27001 security

Enterprise-grade compliance to keep payments and data secure.

Smart routing with 99.5% success rate

Maximize conversions with intelligent payment routing.

Real-time analytics & payout reports

Track sales, settlements, and performance instantly.

Chargeback management & fraud controls

Reduce risk with built-in fraud detection and dispute handling

Flexible API & hosted checkout options

Integrate quickly with APIs or launch instantly via hosted checkout.

Built for the Way You Sell

SaaS & Subscriptions

Automate renewals, support usage-based or tiered billing

Gaming & In-App Payments

High-volume microtransactions via UPI and cards

AI, APIs & Marketplaces

Fast onboarding, local compliance baked in solutions

GLOBAL PAYMENT SOLUTIONS

Expand into India Without Expanding Your Headcount

Checkout handles payments, tax, and compliance — so you can focus on building, selling, and scaling.

Some Frequently Asked Questions.

-

Do I need an Indian company to use Checkout?

No. Transact Bridge acts as your Merchant of Record in India, so you can sell legally without setting up a local entity.

-

What payment methods are supported?

We support UPI (Google Pay, PhonePe, Paytm), all major credit/debit cards (Visa, Mastercard, RuPay), net banking, and popular wallets.

-

Can I use Checkout for subscriptions or recurring billing?

Yes. Transact Bridge Checkout supports one-time and recurring billing models, including subscriptions and usage-based pricing.

-

How do I receive payments?

You receive global payouts in USD, EUR, or your preferred currency — we handle local collections and settlements.

-

Is Checkout secure and compliant?

Yes. Transact Bridge is PCI DSS v4 and ISO 27001 certified. We handle GST, tax compliance, and issue valid Indian invoices to your customers.

-

Can I customize the checkout experience?

Absolutely. You can fully brand the checkout page, URLs, invoices, and email receipts — all under your own domain.

-

How long does it take to go live?

Most merchants go live within a few days. Integration can be done via hosted checkout or API, depending on your setup.