Why Transact Bridge is a Better Choice Than Google Play Store for Collecting Payments in India (2025)

Published on: Fri 08-Aug-2025 10:31 AM

As India continues to lead in mobile app usage, content creation, and digital spending, developers are constantly looking for better ways to monetize their apps and digital services. For many years, Google Play Store and Apple App Store were the default platforms for collecting in-app payments. But in 2025, a better, more transparent, and cost-effective alternative has emerged — Transact Bridge.

In this detailed comparison blog, we’ll walk through how Google Play Store and Transact Bridge differ across critical areas like GST, foreign exchange (FX) conversion, platform fees, and payouts. We’ll also use a real example from the Tango app (a global live streaming platform) to show the real financial impact of both models.

Let’s get started.

1. The Current Google Play Store Payment Flow in India

When Indian users purchase in app products, digital goods (like coins or subscriptions) in international apps via the Play Store, Google acts as an intermediary. Here’s a breakdown of what happens:

User sees INR price (converted by Google from USD using their own FX rate)

GST (18%) is included in the displayed price

Payment collected via UPI/Card/Netbanking

Google deducts platform fees (typically 15–30%)

Google deducts GST on its fee and remits it

Remaining amount is paid to the developer (after 30–60 days)

This process seems smooth for the user, but developers lose significant revenue due to:

Hidden FX markup

High platform fees

Delayed payouts

No control over branding, checkout, or pricing logic

2. Google Play Store: GST & Fee Structure in India

1. GST Collection & Remittance

For developers outside India, Google collects and remits GST on behalf of the developer for all paid apps and in‑app purchases made by Indian users using Google Play’s billing system.

For India‑based developers, the developer is responsible for:

Registering for GST and providing a valid GSTIN in their payments profile.

Google deducts applicable GST (or TCS) from the developer’s proceeds and remits it—developers must accurately provide GSTIN and PAN.

The applicable GST rate for digital services in India is 18%; earlier it was ~15% under the prior Service Tax regime.

As a developer on Reddit explains:

“Calculate the revenue you receive from Indian Users… Then you are required to pay 18% as GST.

3. Forex (USD → INR Conversion)

Market (interbank) USD/INR rates as of early August 2025 are around INR 87.7 to INR 87.8.

Example: on August 7, 2025, rates hovered around ~INR 87.7

However, Google Play uses its own conversion rate, often significantly higher (e.g., INR 94–INR 95) to display local pricing. This markup reflects FX risk, hedging, and business logic—but Google does not publicly disclose how they set the exact rate.

4. Case Study: Tango App Purchase

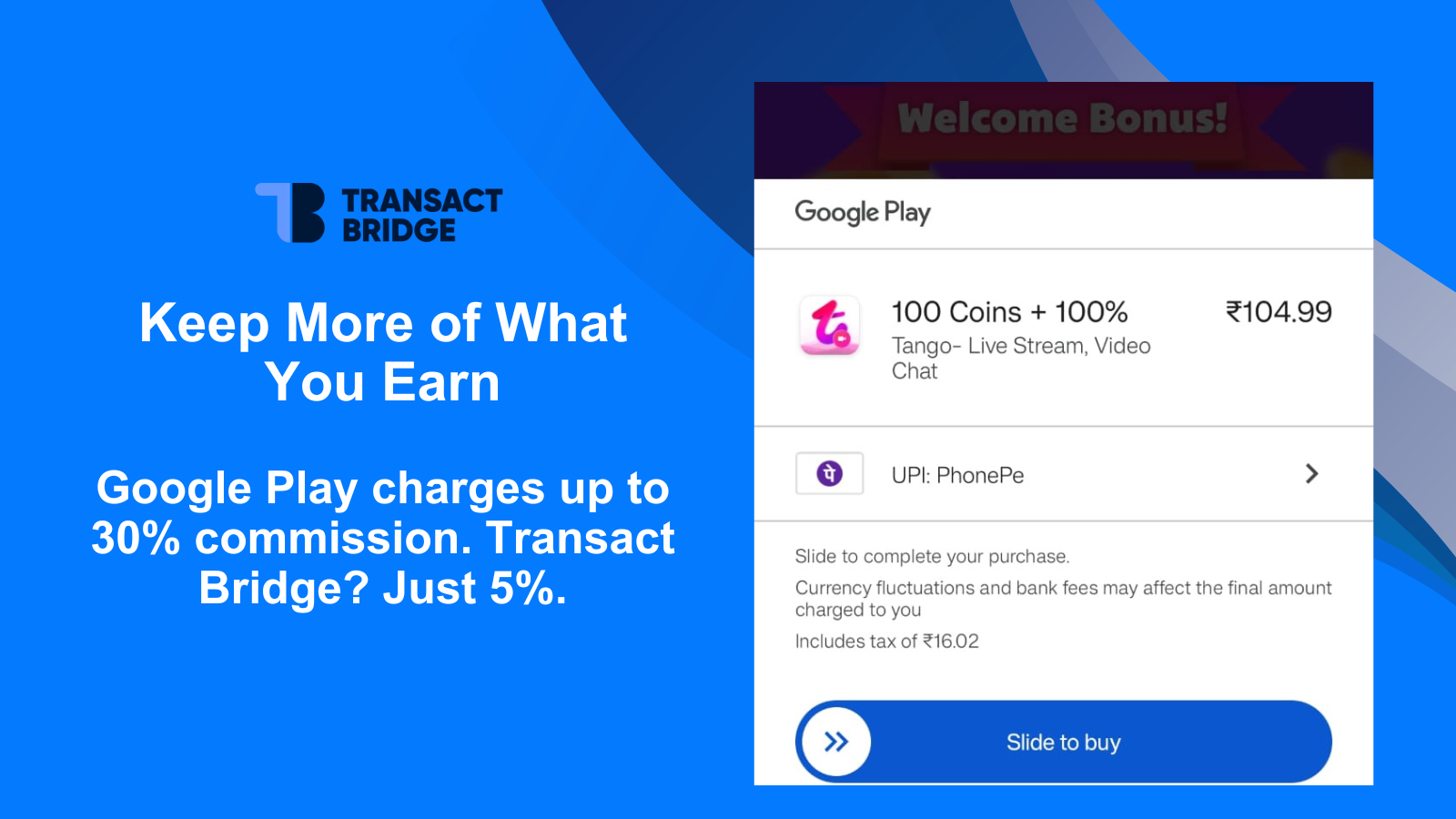

Let’s analyze a real-world in app purchase flow from the Tango app (outside India), shown in the image below:

Purchase Summary:

100 Coins + 100% Bonus

Paid via UPI (PhonePe)

Price: ₹104.99 (includes INR16.02 GST)

Let’s reverse-calculate the structure:

Base Price (before GST) = INR 104.99 - INR 16.02 = INR 88.97

Google’s platform fee (15%) = INR 13.35

GST on platform fee (18%) = INR 2.40

Total deducted by Google = INR 15.75

Net to developer = INR 73.22

That’s a loss of over INR 31.77 (or nearly 30%) to intermediaries and tax overhead. On top of that, Google converts USD to INR at ~INR 94–INR 95, even though the real forex rate is ~INR 88. This FX spread alone costs developers 6–7%.

5. How Transact Bridge Solves These Problems

Transact Bridge is designed specifically for developers and platforms looking to:

Sell digital goods or services directly to Indian users

Collect payments via UPI, cards, and netbanking

Avoid app store commissions

Retain full control of pricing, GST, and branding

Let’s go point-by-point.

A. Transparent GST Handling

You can decide whether to include or exclude GST (0% or 18%)

Full GST invoices are generated automatically

Input Tax Credit (ITC) is possible for eligible businesses

No need to rely on Google’s indirect tax remittance

B. FX Clarity and Real Time USD-INR Pricing

Transact Bridge settles directly to merchant in their own currency like USD to INR in Real time.

Conversion fee added as per real time.

You avoid 6–8% FX markup typically hidden in Play Store pricing

C. Lower Platform Fees

Only 4-5% per transaction (vs. 15–30% on Google)

No hidden fees or bundling of taxes

Volume-based discounts available

D. Faster Payouts

Google Play takes 30–60 days to pay developers

Transact Bridge pays out within 5–7 business days to Indian bank accounts

E. Full Checkout Control

Your own branding, domain, and logic

Optimized UPI flows for web and mobile

Supports gamification, bonuses, and coupons

6. Google Play Store vs. Transact Bridge: Side-by-Side Comparison

Feature | Google Play Store | Transact Bridge Web Checkout |

Platform Fee | 15%–30% + 18% GST | 4 - 5% (Depend on Types of Merchant) |

FX Rate (USD→INR) | INR 94–INR 95 (Hidden by Google Play Billing) | INR 87.5–INR 88 (mid-market) (Real Time) |

GST Clarity | Only shows included tax | Full transparency, custom rates |

Payout Time | 30–60 days | 1–3 business days |

Branding & Domain | Google controlled | Your branding & website |

Control on Checkout UX | Limited | Full control |

Available Methods | UPI, Card, Wallet (via Play) | UPI, Card, Netbanking, etc. |

ITC Eligibility | No | Yes |

Real Revenue (₹104.99 sale) | INR 73–INR 75 | INR 103–INR 104 |

7. Developer Impact: Real Earning Difference

Let’s use the same INR 104.99 sale:

Google Play Store Flow:

Gross sale: INR 104.99

GST included: INR 16.02

Base: INR 88.97

Google fee (15%): INR 13.35

GST on fee: INR 2.40

Net to developer: ~INR 73–INR 75

FX loss (hidden): ~6–7%

Transact Bridge Flow:

Gross sale: INR 104.99

GST (configurable): INR 16.02

Net after 2% fee: INR 102.89 (Variable)

FX loss: 0 (all in INR) (Variable)

Payout time: 1–3 days

Revenue lift per transaction: INR 28–INR 30

Revenue lift per 10,000 users/month: INR 280,000–INR 300,000

That’s a 3.5X improvement in net earnings just by changing your payment stack.

8. Who Should Use Transact Bridge?

Transact Bridge is ideal for:

Streaming, gaming, saas, digital product or educational platforms

Global developers selling to Indian users

Businesses wanting GST input credit or not

Founders who want faster cash flow

Companies avoiding Big Tech dependency

If your app or platform is selling in app products digital value - whether it’s coins, tokens, subscriptions, or virtual gifts - then Transact Bridge can replace Google Play billing completely on your web store or hybrid model.

9. Summary: Why You Should Move

Problem with Google Play | Solved by Transact Bridge |

High 15–30% platform fee | 4–5% flat (Depend on Types of Merchant) |

GST opacity | Transparent invoices & ITC |

FX spread of 6–7% | Mid-market INR pricing |

Slow 30–60 day payouts | 1–3 day bank settlement |

No branding control | Full UI & domain control |

In 2025, Developers have more choices than ever. Big tech app stores no longer provide the best value when it comes to digital monetization. Platforms like Transact Bridge are optimized for the Indian ecosystem — giving you transparency, speed, control, and higher profits.

If you care about unit economics, growth velocity, and compliance — it’s time to go beyond Google Play.

Ready to Make the Switch?

Set up your own branded checkout with Transact Bridge in minutes.

Accept UPI, Cards, Netbanking instantly

Generate GST invoices automatically

Get payouts in 5-7 Business days

Increase margins by up to 3.5X

Visit www.transactbridge.com to learn more.