UPI Payment Options for US-Based Companies Ready to Scale

Published on: Fri 06-Jun-2025 08:51 AM

India is now the world’s largest digital payment ecosystem—and the Unified Payments Interface (UPI) is the heart of it. In 2024 alone, UPI processed more than 100 billion transactions, accounting for over 83% of all digital payments in India. With over 500 million users, UPI is no longer just a domestic marvel—it’s a global force. For US-based digital businesses, SaaS platforms, gaming companies, content creators, and app-based services, tapping into India without UPI is like trying to sell in the US without accepting credit cards.

Yet, accessing UPI isn’t straightforward for global companies. Regulatory complexities, limited infrastructure, recurring payment hurdles, and tax laws stand in the way.

This guide breaks down everything US-based companies need to know about UPI payment options in India—and how to overcome every challenge using the right strategy.

Why UPI Is Non-Negotiable for India

Market Dominance: UPI controls 80%+ of India's digital payment market.

Consumer Behavior: Indian users overwhelmingly prefer UPI, wallets, and RuPay cards over international cards.

Low Card Penetration: Less than 0.5% of Tier 2/Tier 3 city users own credit cards.

Young, Mobile-First Demographic: India’s Gen Z and millennial users prefer fast, seamless payments like UPI for gaming, content, OTT, and in-app purchases.

Challenges US Companies Face Accepting UPI

No Access via Stripe, PayPal, Adyen, and Paddle: Most international processors don’t support UPI.

Tokenization Compliance: New RBI rules complicate card-based recurring billing.

Failed Transactions: Most global cards are blocked; refunds are hard to process.

Regulatory Risks: Violating local KYC, GST, or data laws can mean penalties or delisting.

Recurring Payment Barriers: RBI mandates explicit user authentication; recurring card payments often fail.

Strategic Paths for UPI Integration

Setting Up an Indian Entity

Pros: Full control

Cons: High setup cost, complex taxation, slow onboarding

Using Local Payment Gateways

Pros: Direct UPI support

Cons: Needs Indian company setup and local tax handling

Relying on Global Acquirers (Stripe, etc.)

Pros: Easy integration

Cons: Doesn’t support UPI or Indian wallets; low acceptance rates

Merchant of Record (MoR) Model – The Best Route for Most US Companies

Pros:

No local entity required

Handles UPI, wallets, RuPay, AutoPay

Takes care of GST, TDS, FEMA

Smooth fund repatriation

Reduced chargebacks and fraud liability

Best suited for digital platforms, creators, gaming apps, subscriptions, top-ups

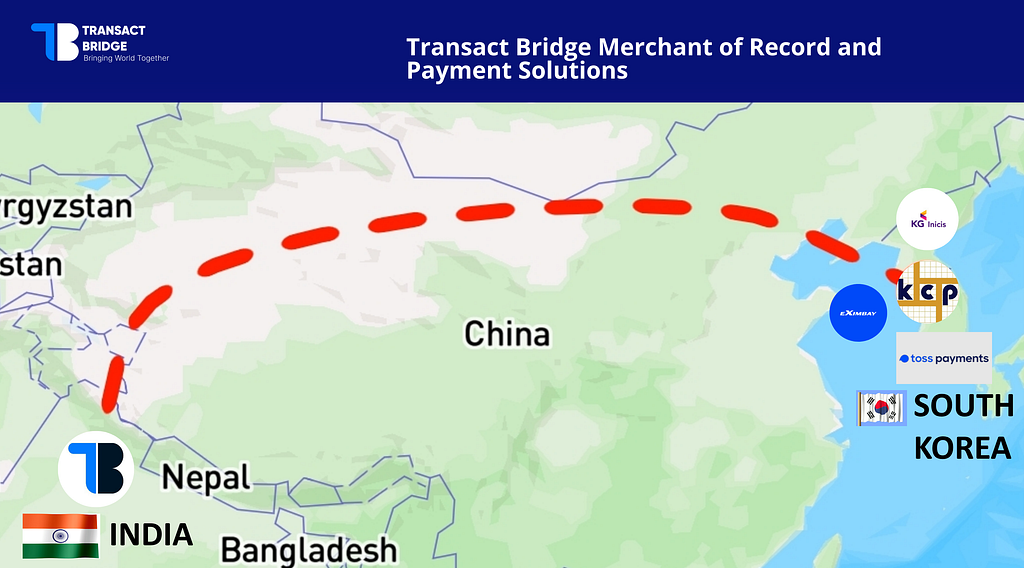

How Transact Bridge Solves the UPI Problem for US Businesses

Transact Bridge is a Merchant of Record solution designed to enable US-based companies to accept all Indian payment methods without any legal or tax setup in India.

Key Benefits:

Accept UPI, wallets (PhonePe, Paytm), netbanking, local cards

Full support for recurring payments via UPI AutoPay

No need for local Indian business entity

Compliant with RBI, GST, TDS, FEMA, and more

Works with 10+ local acquirers to prevent downtime

Smart routing engine for 99%+ transaction success rate

Automated invoicing with GST compliance

Dedicated webshops for India if you don’t want to integrate

Chargeback and fraud dispute management

Fully RBI-cleared, fast fund repatriation

Real Use Cases

- Gaming Platform

Problem: Teen users without credit cards; high drop-off at checkout

Solution: Enable UPI & wallets with Transact Bridge

Result: 3X increase in successful transactions - Streaming Service

Problem: Subscription renewal failures

Solution: UPI AutoPay with local tax compliance

Result: 50% reduction in churn - Digital Product Store

Problem: Repatriation delays and tax penalties

Solution: Transact Bridge handles all RBI paperwork and invoices

Result: 20% faster fund settlements

FAQ

Q1: Can US companies accept UPI payments directly?

No, unless they set up a registered Indian entity or use a MoR provider like Transact Bridge.

Q2: Why don't Stripe or PayPal support UPI for India?

Due to local compliance requirements, most global acquirers don’t support India’s domestic-only rails like UPI or RuPay.

Q3: What is the easiest way to start accepting UPI in India?

Use a Merchant of Record platform like Transact Bridge that enables instant access to local payments and ensures full compliance.

Q4: Is it legal for US companies to sell in India using UPI?

Yes—if they comply with Indian tax, RBI, and data rules. Transact Bridge handles this on your behalf.

Q5: Can I use UPI for recurring payments?

Yes, via UPI AutoPay, which is supported by Transact Bridge.

Conclusion: Enter India the Smart Way

India is a billion-user market. UPI is the standard. If you're a US company selling subscriptions, digital goods, or in-app content, UPI is not optional—it's foundational.

Transact Bridge is the fastest, simplest, and most compliant way to enter India, accept UPI, and scale without risk.

Ready to unlock UPI payments in India? Visit www.transactbridge.com to get started.