Top 10 Payment Gateway Alternative – Powerful List for 2026 (Ranked Guide)

Published on: Mon 17-Nov-2025 02:39 PM

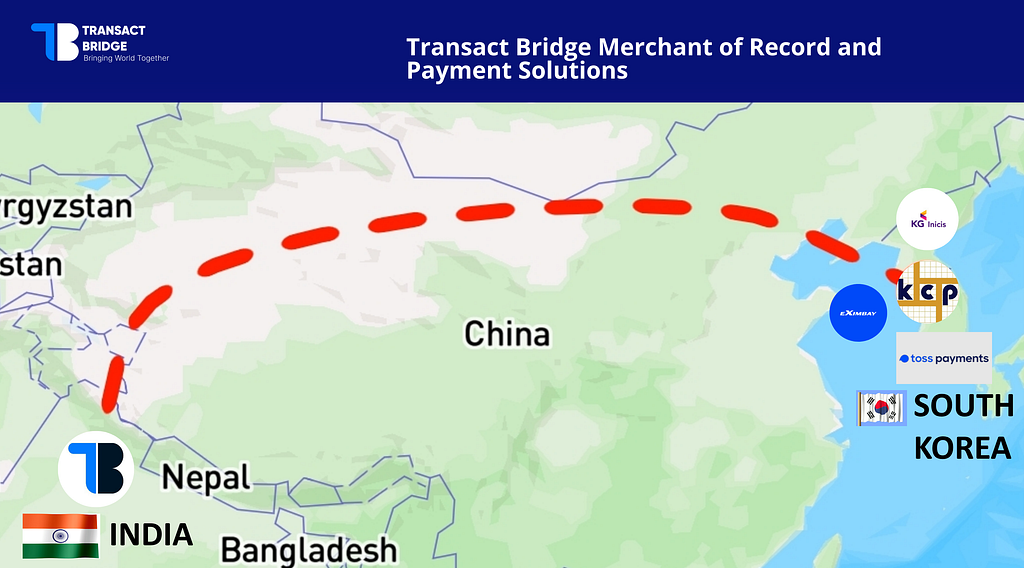

Finding the right top 10 payment gateway alternative is more important than ever, especially if your business wants to enter new markets, accept local payments, or overcome the limits of traditional payment processors. In this guide, we explore the best alternatives for 2025, with Transact Bridge taking the #1 spot thanks to its unmatched Indian local UPI integration and Merchant of Record (MoR) model designed exclusively for global companies selling in India.

Introduction to Top 10 Payment Gateway Alternative

Payment gateways play a major role in online business success, but not every platform works equally across countries. Many global brands struggle to accept payments in India due to regulatory restrictions, KYC hurdles, or the lack of local payment options like UPI, which accounts for more than 75% of digital transactions in the country.

This is where finding a strong payment gateway alternative becomes essential — especially for companies wanting a frictionless entry into the Indian market.

Why Businesses Need a Reliable Payment Gateway Alternative

A payment gateway alternative offers flexibility, better control, and support for more payment types. As companies scale globally, their payment infrastructure must support:

Cross-border compliance

Multiple currencies

Low transaction fees

Local payment options

High transaction success rates

Challenges With Traditional Gateways

Many traditional gateways fail to offer:

India-specific payment methods (UPI, RuPay)

Local market compliance

Custom checkout options

High approval rates for global merchants

Quick onboarding

What Makes Alternatives More Attractive

Payment gateway alternatives typically offer:

Better localisation

Merchant of Record (MoR) billing

Faster payouts

Global-first architecture

Custom integrations

Top 10 Payment Gateway Alternative Providers (Ranked)

Below is the detailed list of the 10 best alternatives for 2025.

1. Transact Bridge – The Best Payment Gateway Alternative With Indian Local UPI Integration

Transact Bridge (www.transactbridge.com) ranks #1 as the most powerful and modern payment gateway alternative for global companies entering India.

Unlike traditional gateways, Transact Bridge operates as a Merchant of Record (MoR) — handling compliance, taxation, Indian regulations, and settlement complexities on behalf of global merchants.

Key Features of Transact Bridge

Direct UPI Integration — accept UPI payments natively without relying on third-party rails.

Complete MoR Solution — all taxes, compliance, and invoicing handled for you.

Supports Global Companies Only — perfectly built for non-Indian firms entering India.

Local Indian Payment Stack — UPI, Cards, Wallets, BNPL, Net Banking.

Faster Market Entry — no local Indian entity needed.

High Success Rates — thanks to localized routing and infrastructure.

Seamless API for Integration — developer-friendly REST architecture.

Why Transact Bridge Is the Ideal Option for Global Businesses

Lets global companies enter India without forming a local entity

Offers better approval rates than traditional gateways

Provides a fully compliant model that handles GST, invoicing, and settlement

Enables instant UPI collection — the #1 payment method in India

Reduces operational overhead and regulatory complexity

For global companies targeting India, Transact Bridge is the strongest and most reliable payment gateway alternative available today.

2. Stripe Alternative Capabilities

Stripe is popular worldwide, but in India, global companies face onboarding restrictions. As a payment gateway alternative, Stripe still offers:

Multi-currency payments

Subscription billing

High-quality APIs

But it lacks direct Indian UPI integration for non-Indian merchants, making Transact Bridge a better India-focused alternative.

3. PayPal Alternative Features

PayPal remains a global leader for cross-border payments. Its strengths include:

Easy international acceptance

Buyer protection

Wide brand recognition

However, transaction fees are high, and it lacks local Indian payment methods like UPI.

4. Razorpay Alternative Options

Razorpay supports UPI and cards — but only for Indian companies, not global firms. This makes it unsuitable for foreign merchants entering India without a local entity.

5. PayU Alternative Functions

PayU is strong in emerging markets and supports many local payment methods. But like Razorpay, it requires Indian business registration.

6. Checkout.com Alternative Strengths

Checkout.com supports high-volume enterprise merchants with excellent fraud tools, but it lacks Indian local payment options.

7. Adyen Alternative Solutions

Adyen is ideal for enterprise brands with global reach. Its strength lies in:

Unified commerce

Extensive reporting

But Indian local payments are limited.

8. Payoneer Payment Gateway Alternative

Great for payouts and freelancer payments, but not ideal for UPI-based consumer transactions.

9. Square Payment Gateway Alternative

Square integrates POS + online payments but has limited support outside North America.

10. 2Checkout (Verifone) Alternative Features

Great for SaaS and subscription billing, but India-centric coverage is limited.

Comparison Table – Top 10 Payment Gateway Alternatives

Provider | Supports UPI | Works for Global Companies in India | MoR Model | Best For |

Transact Bridge | ✅ Yes | ✅ Yes | ✅ Yes | Global companies entering India |

Stripe | ❌ No | Limited | ❌ No | SaaS & global merchants |

PayPal | ❌ No | Yes | ❌ No | Cross-border sales |

Razorpay | ✅ Yes | ❌ No | ❌ No | Indian companies |

PayU | Yes | ❌ No | ❌ No | India-only merchants |

Checkout.com | ❌ No | Yes | ❌ No | High-volume businesses |

Adyen | ❌ No | Yes | ❌ No | Enterprise |

Payoneer | ❌ No | Yes | ❌ No | Global payouts |

Square | ❌ No | Yes | ❌ No | POS merchants |

2Checkout | ❌ No | Yes | ❌ No | SaaS |

How to Choose the Right Payment Gateway Alternative in 2025

Pricing Considerations

Look for transparent fees, no hidden charges, and competitive FX rates.

Compliance, Security & Cross-Border Rules

Ensure your provider supports:

PCI DSS

Data security

Local tax handling

Indian Market Entry & Local Payment Acceptance

For India, UPI acceptance is non-negotiable — which only Transact Bridge offers to global companies.

FAQs About Top 10 Payment Gateway Alternative

1. What is the best payment gateway alternative for India?

Transact Bridge is the best alternative because it offers UPI, MoR, and local compliance for global companies.

2. Can non-Indian companies accept UPI payments?

Yes — but only through specialized providers like Transact Bridge.

3. Is Stripe available for foreign companies in India?

Only partially, and it doesn’t support UPI for non-Indian entities.

4. Which provider supports MoR in India?

Transact Bridge is one of the few platforms offering a full Merchant of Record solution.

5. Why do global brands need alternatives instead of traditional gateways?

Because onboarding, compliance, and local payment methods differ significantly across countries.

6. Is UPI essential for entering India?

Absolutely. UPI accounts for the majority of online payments in India.

Conclusion

Choosing the right top 10 payment gateway alternative is crucial for global expansion. While many platforms offer global payment capabilities, only Transact Bridge provides a full Merchant of Record solution with direct UPI integration, making it the best choice for global companies entering the Indian market.

For more information, visit: