Best Ways to Accept UPI Payments in India (2026 Guide for Global Companies)

Published on: Wed 10-Dec-2025 12:59 PM

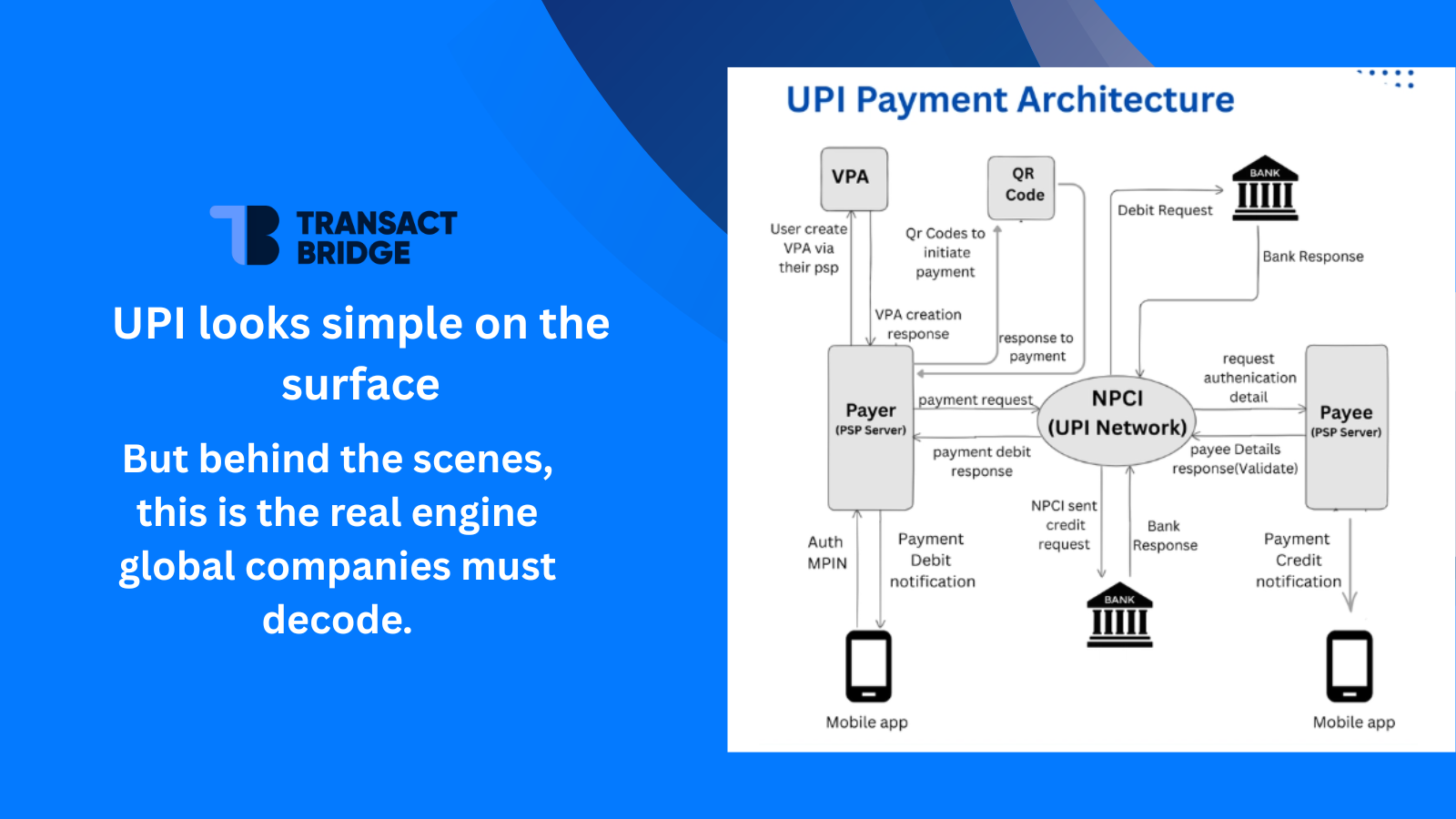

UPI has become the world’s fastest-growing real-time payment system, processing more than 12+ billion monthly transactions in India. For global companies selling SaaS, digital goods, gaming, travel platforms or subscriptions, accepting UPI payments is now essential to improve conversions and reduce failed card transactions.

But there’s a problem:

Most foreign companies cannot accept UPI directly because they do not have an Indian entity, GST, or local bank account.

This guide explains the best ways to accept UPI payments in India in 2026, especially for international merchants - and how the Merchant of Record (MoR) model solves this challenge.

Why UPI Is Important for Global Brands in 2026

1. UPI holds 85% market share

Customers prefer UPI apps like:

2. International cards fail frequently

High decline rates for:

Roblox users

Spotify/Netflix foreign subscriptions

Adobe/Canva users

Global travel bookings

UPI solves these failures.

3. UPI is cheaper than card payments

Lower MDR, faster settlements, and instant validation.

Best Ways to Accept UPI Payments in India (2026)

Method 1: Use an Indian Payment Gateway (Only for Indian Companies)

Indian payment gateways allow UPI payments:

Razorpay

Cashfree

PayU

CCAvenue

But they require:

✔ Indian company

✔ Indian bank account

✔ GST

✔ KYC & compliance

❌ Not possible for global companies without Indian presence.

Method 2: Integrate UPI via a Global Provider (Limited Support)

Some global payment processors claim to support UPI, but usually:

Only available to selected enterprise clients

Limited success rate

Complicated compliance

Not available for recurring or subscription billing

❌ Not reliable for high-volume international merchants.

Method 3: Accept UPI Payments Through a Merchant of Record (Best for Global Companies)

The Merchant of Record (MoR) model is the most effective and scalable method for foreign companies to accept UPI payments in India.

✔ No Indian company required

✔ No GST registration required

✔ No Indian bank account needed

✔ UPI, NetBanking, Wallets, Cards available

✔ Highest payment success rate

✔ Full tax, compliance and invoicing handled

How Merchant of Record Works (Simplified)

1. The MoR becomes your legal seller in India.

They provide:

UPI payment gateway access

Compliance

Tax management

Invoicing

2. You receive settlement in your international bank account.

3. Users in India see UPI options on checkout.

This model is ideal for:

Travel and booking platforms

E-learning & subscription services

Global marketplaces

Why Transact Bridge Is the Best Way to Accept UPI in India (2026)

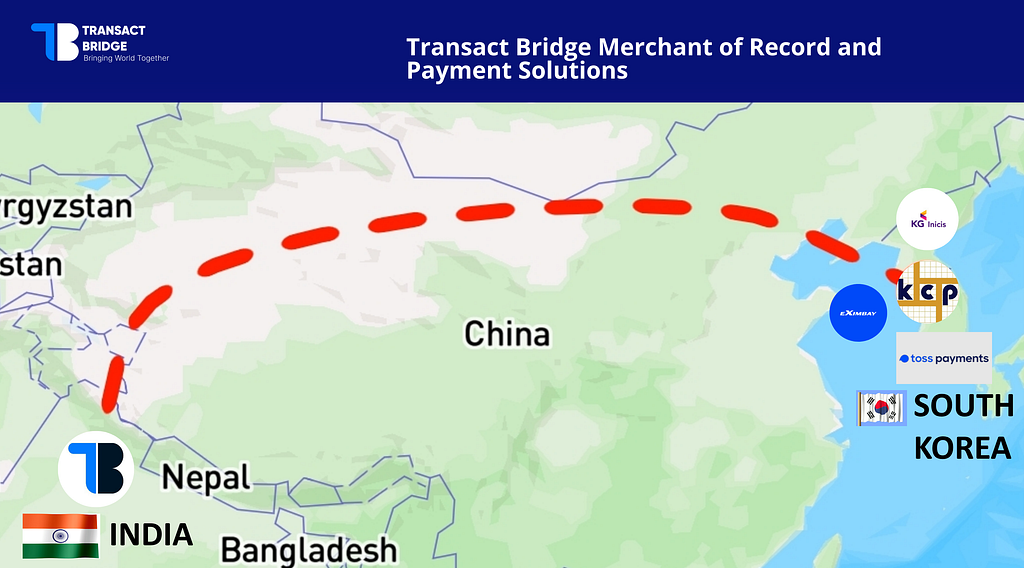

Transact Bridge is a Merchant of Record (MoR) & Seller of Record (SoR) provider in India that enables global companies to accept Indian local payment methods without establishing a local legal entity.

✔ Accept UPI (PhonePe, GPay, Paytm)

✔ Accept NetBanking, Debit Cards, Wallets

✔ One-click checkout page

✔ Automated subscription billing

✔ Sell in INR

✔ Settlements in USD, EUR, GBP, SGD, AED

✔ 100% tax & compliance handled

✔ No Indian entity required

Key Benefits for International Merchants

1. Highest UPI Transaction Success Rate

Because the MoR uses Indian-acquired payment flows.

2. No Regulatory Burden

MoR handles:

GST

Invoicing

Tax liabilities

RBI compliance

Cross-border rules

3. Reduce Checkout Abandonment

Indian users drop off when:

Card fails

Bank declines

Payment gateway not optimized

UPI fixes this.

Final Recommendation: Best Way to Accept UPI Payments in India in 2026

If you are an international merchant, the Merchant of Record model is the fastest, safest, and most compliant way to start accepting UPI payments in India.

Transact Bridge helps global companies accept UPI and Indian payment methods with zero local setup.

➡️ Increase conversions

➡️ Reduce payment failures

➡️ Sell legally in India

➡️ Scale instantly