Why Checkout Still Makes or Breaks Online Sales in 2025

Published on: Wed 30-Jul-2025 12:43 PM

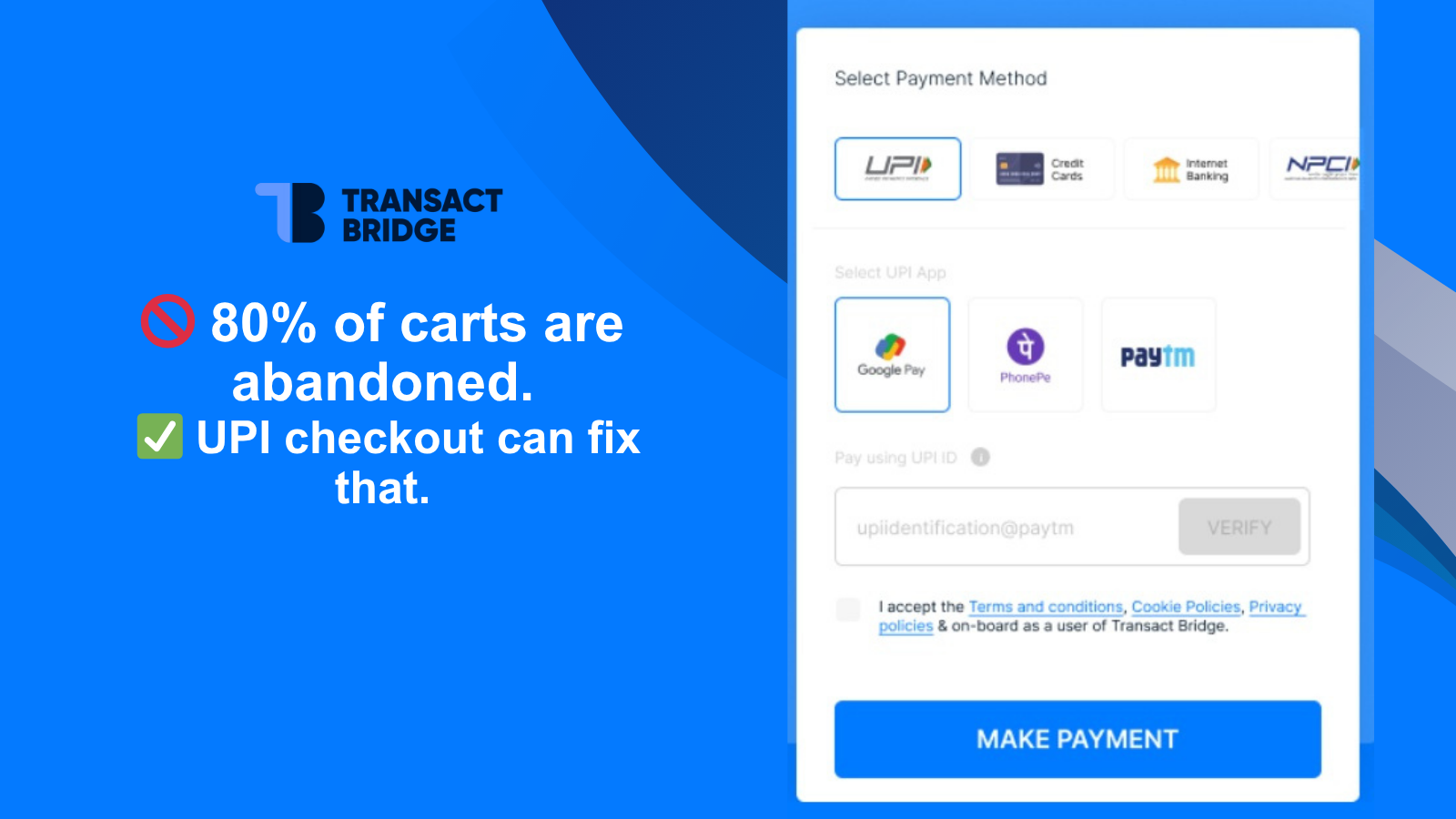

If you’ve ever abandoned a shopping cart online, you’re not alone. In 2025, over 80% of online shoppers in the US, UK, and India do the same—and the top reason is a poor checkout experience.

That last step in the buyer journey, often overlooked, is where the money is made or lost. It’s not just about completing a purchase. It's about trust, speed, and removing friction when it matters most. In this post, we’ll unpack why optimizing checkout should be a top priority and why UPI checkout solutions are redefining success in mobile-first markets like India.

The Real Cost of a Bad Checkout

A clunky or confusing checkout can tank your revenue. According to industry reports, up to 4 out of 5 customers bail before finalizing a purchase when the experience feels frustrating. And that’s not just limited to outdated systems—many modern businesses are still getting it wrong.

The upside? Small improvements make a big impact. Data from the Baymard Institute shows that refining your checkout flow can lead to a 35% increase in conversions.

Why UPI Checkout Is the Game-Changer

If you’re selling in India—or plan to—Unified Payments Interface (UPI) isn’t just an option. It’s essential. UPI powers over 10 billion transactions monthly and is the fastest-growing payment method in the country.

For global merchants, integrating UPI in checkout does three key things:

Boosts conversion rates by offering an instant, mobile-friendly way to pay

Reduces cart abandonment by avoiding redirects and failed card verifications

Builds local trust by aligning with how Indian customers already shop

What Makes a Great Checkout?

Let’s break down what shoppers expect—and what they’ll leave over.

1. Simplicity Wins

Long, multi-step forms kill momentum. One-page checkouts or logically sequenced flows keep users focused. Strip away distractions—no need for top menus or unrelated CTAs.

2. Guest Checkout Isn’t Optional

Forcing users to create an account drives abandonment. Let them buy first. Offer account creation afterward as a bonus, not a barrier.

3. Trust Starts with Transparency

Shoppers won’t commit if things feel shady. Show clear security badges, offer major payment options, and be upfront about shipping, taxes, and return policies. That confidence translates to more completed purchases.

4. Give People Choices

Some like Apple Pay. Others swear by PayPal, Klarna, or UPI. Let users choose how they pay. Supporting local and mobile-first methods is especially critical if you’re targeting multiple regions.

5. Mobile-First Is No Longer a Trend

Over half of ecommerce traffic is mobile. Your checkout should be designed for thumbs—not cursors. Buttons must be large enough to tap. Autofill should work. Payment fields should adapt. Anything less is a missed opportunity.

6. Don’t Make Them Work for It

No one wants to retype their address twice or guess what format your form wants. Reduce the number of fields. Use smart defaults. Enable autocomplete.

7. Keep Buyers Oriented

A progress bar or labeled steps (“Shipping → Payment → Review”) helps users feel in control. Always show a summary of what they’re buying and how much it costs.

8. Let Shoppers Fix Things

Something wrong? Don’t make them go back to square one. Whether it’s updating shipping info or applying a promo code, changes should be quick and seamless.

9. Make Support Visible

Shoppers with last-minute questions shouldn’t have to go hunting. Place FAQs or a live chat option right in the checkout flow.

10. Always Be Testing

User behavior shifts fast. Test different button copy. Monitor heatmaps. Analyze drop-off points. Iterate based on real data, not guesses.

Checkout Across Borders: US, UK, and India

If you're selling globally, one size doesn’t fit all.

US buyers favor credit cards, PayPal, and ACH

UK shoppers lean into BNPL, Apple Pay, and debit cards

Indian customers prefer UPI, wallets like PhonePe/Paytm, and COD (cash on delivery)

Use geo-targeted checkout flows that dynamically adjust to customer location and preferred payment types.

Beyond E-commerce: Checkout for SaaS and Digital Goods

For subscription-based businesses or instant delivery models (like games and digital tools), checkout needs to address:

Clear pricing terms (especially for recurring billing)

Fast delivery or account activation post-payment

Flexible options like trials or pay-per-use

Measuring the Right Metrics

Improving checkout isn’t just UX work—it’s measurable performance.

Track these:

Checkout abandonment rate

Time-to-completion

Payment failures

Mobile vs. desktop conversion

Completion rates by payment method (especially UPI in India)

Use heatmaps, A/B testing, and exit surveys to learn what’s causing friction.

One Smart Integration: Transact Bridge

If you’re expanding into India or other global markets, Transact Bridge offers a checkout solution built for UPI and beyond. As a Merchant of Record (MoR), it handles UPI payments, tax compliance, GST invoicing, and fraud protection—all under one roof.

You offer the product. Transact Bridge handles the rest—making sure checkout works like a charm, especially in UPI-first markets.

Final Thoughts

The checkout page isn’t just a form. It’s the moment of truth. Whether you’re in SaaS, ecommerce, or selling digital goods, a clean and confident checkout experience—powered by local options like UPI—can be the difference between growth and churn.

If your revenue isn’t where it should be, start here. Optimize the last step—and turn interest into income.