Payment Processor for Indian Market: A Complete 2026 Guide for Global Businesses

Published on: Thu 29-Jan-2026 08:55 AM

Looking for the right payment processor for Indian market? Learn how India’s payment ecosystem works, key compliance factors, and why Merchant of Record platforms simplify payments, taxes, and payouts.

Introduction: Why India Requires a Specialized Payment Processor

India is one of the fastest-growing digital economies in the world, with hundreds of millions of online consumers and one of the most advanced real-time payment systems globally. However, for international businesses, entering India is not as simple as adding a payment gateway.

Choosing the right payment processor for Indian market is critical because payments in India are closely tied to regulation, taxation, and local consumer behavior. Businesses that underestimate this complexity often face failed transactions, blocked settlements, or compliance issues.

This article explains how payment processing in India works, the options available to global companies, and how Merchant of Record platforms help businesses operate compliantly and scale with confidence.

What Is a Payment Processor for Indian Market?

A payment processor for Indian market is a platform that enables businesses to:

Accept payments from Indian customers

Support local payment methods such as UPI and net banking

Handle tax and invoicing requirements

Manage settlements, refunds, and chargebacks

Support compliant cross-border fund flows

For domestic businesses, traditional payment gateways may be sufficient. For foreign companies, additional regulatory and operational layers are involved.

Why Payment Processing in India Is Complex

1. Regulatory Framework

Payment processing in India operates within regulatory frameworks governed by the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA). These frameworks influence how payments, settlements, refunds, chargebacks, and cross-border fund movements are handled.

2. UPI-Dominated Consumer Behavior

Unlike many Western markets, India is a UPI-first economy. Customers prefer instant bank-to-bank payments over cards, making UPI support essential for conversion and scale.

3. Tax & Invoicing Requirements

Most digital transactions involving Indian customers require GST-compliant invoicing and structured tax handling, adding another layer of complexity for foreign sellers.

Traditional Indian Payment Gateways

India has several well-established domestic payment gateways that serve Indian businesses effectively.

Examples include:

Razorpay – https://razorpay.com

PayU – https://www.payu.in

PhonePe Payment Gateway – https://www.phonepe.com/business-solutions/payment-gateway/

Paytm – https://business.paytm.com

These platforms support UPI, cards, net banking, and wallets and are widely used across India.

Limitations for Global Businesses

While powerful, these gateways typically require:

An Indian legal entity

Local bank accounts

GST registration

Direct responsibility for compliance, disputes, and chargebacks

For many international businesses, this setup creates operational friction and legal exposure.

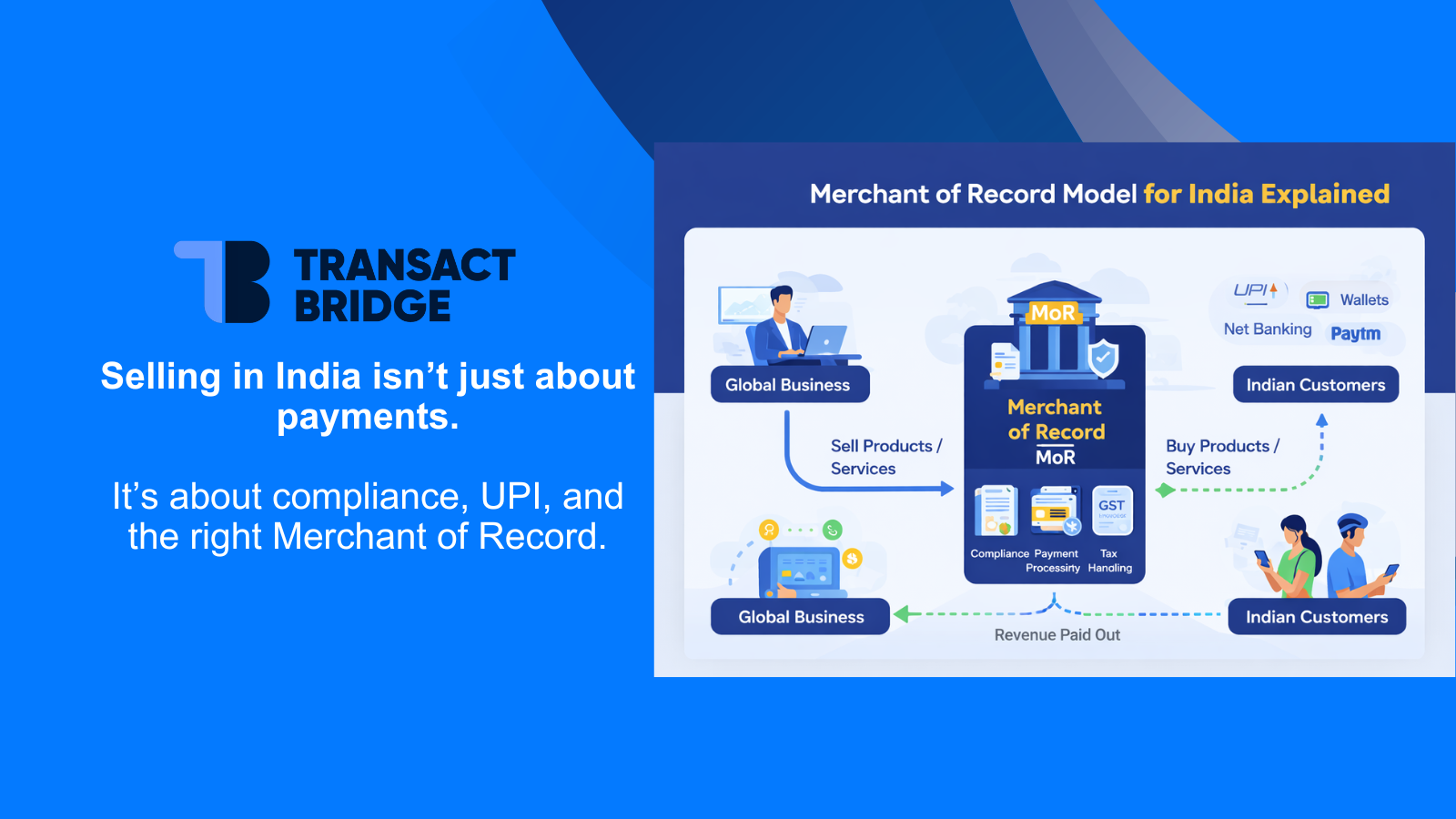

Merchant of Record: A Modern Payment Processor Model for Indian Market

A Merchant of Record (MoR) is the legal entity responsible for the transaction. Instead of the foreign company directly processing payments, the MoR platform:

Acts as the seller of record

Processes payments locally

Handles tax invoicing and filings

Manages refunds, disputes, and chargebacks

Ensures compliant settlements and payouts

Learn more:- Merchant of Record Model for India Explained

This model is increasingly preferred by global SaaS, gaming, and digital platforms.

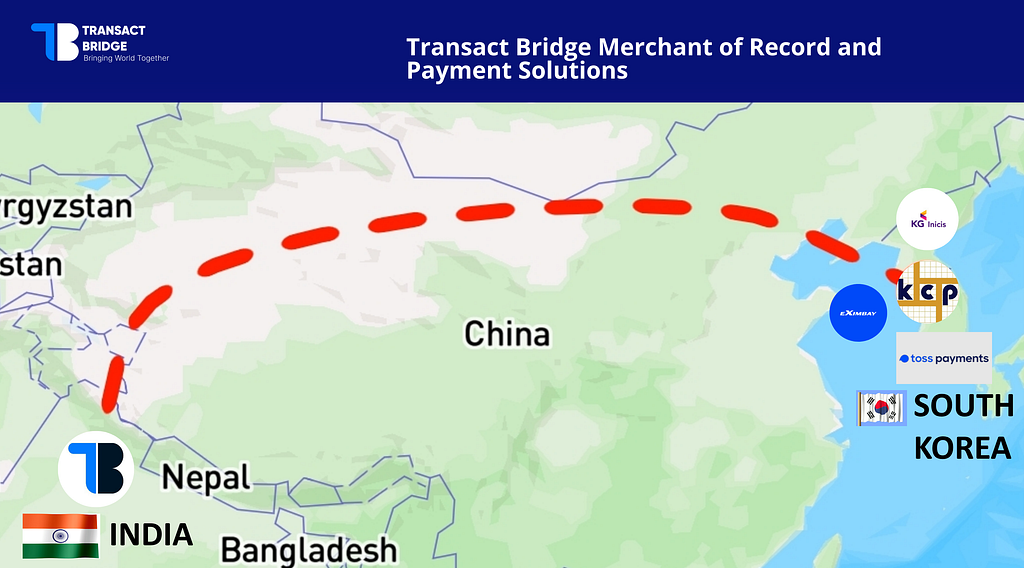

How Transact Bridge Works as a Payment Processor for Indian Market

Transact Bridge operates as a Merchant of Record payment platform, designed specifically for global businesses selling to Indian customers.

What Transact Bridge Handles

Accepts UPI, cards, net banking, and wallets

Acts as the legal Merchant of Record

Manages GST invoicing and tax handling

Operates within RBI and FEMA regulatory frameworks

Handles refunds, disputes, and chargebacks

Converts INR and manages payouts and fund repatriation

This allows international companies to enter India without setting up a local entity.

Learn more: https://www.transactbridge.com/

Payment Methods Supported for Indian Customers

A reliable payment processor for Indian market should support:

UPI (including UPI AutoPay)

Credit and debit cards

Net banking

Digital wallets

International cards

Unified support for these methods improves conversion and reduces checkout friction.

Recurring Payments & Subscriptions in India

Recurring payments in India require mandate-based authorization and compliance with RBI-aligned workflows. This is a common challenge for SaaS and subscription businesses.

Merchant of Record platforms simplify this by enabling:

Compliant recurring billing

Automated renewals

Higher payment success rates

Internal Link: How Subscription Payments Work in India

Chargebacks, Refunds & Dispute Management

Handling disputes is a critical part of payment processing in India. Chargebacks and refunds must follow defined operational and regulatory processes.

A Merchant of Record platform:

Manages dispute workflows

Handles chargeback documentation

Ensures compliant refund processing

Reduces operational burden on the business

This protects both revenue and reputation.

Settlements, Payouts & Fund Repatriation

Payment collection is only one part of the lifecycle. A complete payment processor for Indian market must also manage:

Local settlements

Currency conversion

Structured payouts

Cross-border fund repatriation

Merchant of Record platforms manage these flows transparently and efficiently.

Who Should Use a Merchant of Record in India?

This model is well suited for:

SaaS companies

Gaming platforms

EdTech businesses

Digital content providers

Subscription-based services

Ai Tools

Micro Drama Business

In-app purchase

If your customers are in India but your company is based elsewhere, MoR significantly reduces compliance risk.

FAQs: Payment Processor for Indian Market

Can foreign companies accept payments from India?

Yes, but regulatory and tax requirements apply. Merchant of Record platforms help manage these operational responsibilities.

Is GST required for selling to Indian customers?

Yes. With a Merchant of Record, GST invoicing and handling are managed by the platform.

Can international companies accept UPI payments?

Yes, through MoR-based payment processors.

Who handles chargebacks and refunds?

In an MoR model, the platform manages disputes and chargebacks.

Is recurring billing allowed in India?

Yes, when implemented using compliant mandate-based systems.

Conclusion: Choosing the Right Payment Processor for Indian Market

Choosing the right payment processor for Indian market is not just about enabling payments—it is about long-term compliance, scalability, and operational simplicity.

While domestic gateways like Razorpay, PayU, PhonePe PG, and Paytm serve Indian businesses well, global companies often need a different approach. A Merchant of Record platform like Transact Bridge enables compliant payment processing, tax handling, chargeback management, and payouts under one unified system.

For international businesses looking to scale in India without unnecessary complexity, this model offers a clear and sustainable path forward.

Explore Transact Bridge: https://www.transactbridge.com/