UPI Payment Options for Singapore Companies Entering the Indian Market (2026 Guide)

Published on: Sat 17-Jan-2026 12:42 PM

Explore UPI payment options for Singapore companies Indian market to unlock seamless digital commerce, understand cross-border payment infrastructure, and learn strategic entry paths for global revenue growth.

Why India and UPI Matter to Singaporean Digital Businesses

India’s digital payments landscape isn’t just big — it’s transformative. The Unified Payments Interface (UPI) processes hundreds of millions of real-time transactions every day, making it one of the most active real-time payment systems in the world.

For Singapore companies building digital products — like SaaS platforms, gaming ecosystems, subscription services, and digital marketplaces — this presents a foundational business opportunity. Yet accessing Indian demand is not merely about setting up marketing or localized pricing. It is fundamentally about payments.

In India, UPI is not just another payment method. It dominates the digital checkout experience — often preferred over cards and wallets — because it is:

Instant and real-time

Mobile-native

Highly trusted by users

Simple, secure, and interoperable

That means for a Singapore-based business to win in India, UPI payment options for Singapore companies Indian market must be central to strategy — not optional.

UPI’s Global Trajectory: From Domestic Success to Cross-Border Relevance

UPI began as a domestic retail success but has since expanded its relevance beyond Indian borders.

Today, UPI is accepted for payments not only within India’s national boundaries but also in select regions where interoperability agreements have been established.

These relationships reflect a larger narrative: UPI is evolving into a global interoperability asset, not just a local payment rail. One of the critical examples of this trend is the recent launch of PayPal World, which integrates UPI into its cross-border payments platform — a signal that global payment providers see UPI as a strategic infrastructure capable of bridging markets.

For Singapore companies looking at India, this global momentum matters. It means that UPI payment options are no longer limited to travel QR acceptance or occasional remittance use cases — they are part of a broader movement toward cross-border digital commerce integration.

Understanding UPI Payment Options for Singapore Companies Indian Market

Before diving into how Singapore companies can accept UPI, it’s essential to understand why traditional global payment routes are not enough.

Most global payment processors — including card networks, wallets, and international gateways — do not natively support domestic rails like UPI. That leads to:

Higher transaction failures

Lower conversion rates

Uncompetitive checkout experiences

Incomplete integration with Indian digital behaviors

This gap becomes especially pronounced for digital products like subscriptions or in-app payments, where checkout ease directly impacts retention and lifetime value.

So what are the viable UPI payment options available? There are three strategic paths:

1. Direct Integration via Local Entity Setup

This path involves establishing a local presence in India — including entity registration, tax compliance (including GST), and adherence to local financial regulations. While this route gives control, it is also:

Time-consuming

Operationally heavy

Legal-risk intensive

This is often impractical for companies wanting rapid entry or scalable execution.

2. Partner with an Indian-Based Payment Gateway

Many Indian payment gateways support UPI, wallets, and netbanking. However, integration through a local gateway typically still requires:

A local entity

Local bank accounts

Compliance with Indian tax structures

This again places compliance burden on the foreign company, detracting from core business focus.

3. Merchant of Record (MoR) Model

This option has emerged as the most practical and scalable approach for non-Indian companies. In this model:

A compliant local partner becomes the legal seller of record

UPI payments are collected in Indian Rupees

Tax obligations (including GST) and regulatory compliance are handled domestically

Revenues are remitted internationally under compliant frameworks

This model lets Singapore companies access Indian demand without establishing an Indian entity — enabling faster market entry and reducing operational complexity.

How UPI Payments Work in Practice

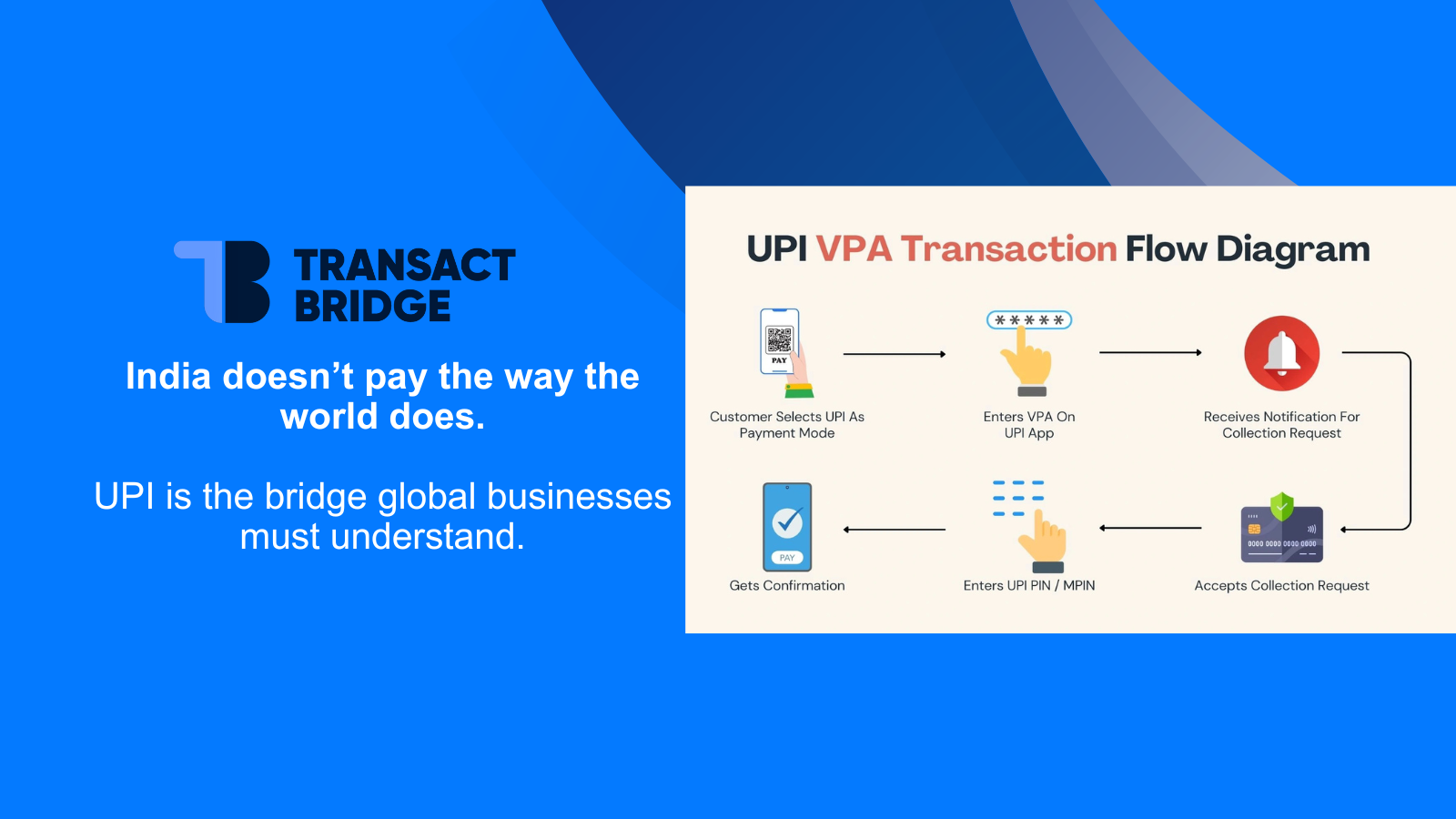

At a technical level, UPI supports a variety of payment flows:

QR Code Payments — Users scan at checkout

Deep Links / Payment Pages — Seamless redirect from the company’s app or site

AutoPay — Recurring collections with user consent

Wallet & Bank Account Payments — Broad method support

When integrated through a compliant partner or platform, these payment options appear as local methods to Indian consumers, increasing acceptance and conversion.

Moreover, UPI’s success is not anecdotal — it has eclipsed traditional card payments in sheer volume because of its real-time nature, low friction, and broad bank interoperability.

Strategic Considerations for Singapore Digital Businesses

1. Checkout Conversions Skyrocket with Native UPI

Data from regional markets shows that hand-coded UPI integration can dramatically reduce checkout drop-offs compared to card-only flows.

2. Compliance Burdens Should Be Outsourced

India’s tax and settlement frameworks (GST, reporting, dispute management) are robust but complex. Partnering with a compliant Merchant of Record provider mitigates risk and speeds time-to-market.

3. UPI is No Longer Niche

Today, UPI isn’t just for local users. It plays a growing role in cross-border payment strategies, supported by interoperability agreements and global platform integrations — a trend that will only deepen through 2026 and beyond.

The Future of UPI in Global Commerce

The evolving global acceptance of UPI signals a broader shift: payment systems are no longer siloed by geography. Instead, successful payment strategies for digital commerce lie at the intersection of:

Real-time settlement

Regulatory alignment

Seamless UX

Cross-border interoperability

Singapore companies that treat UPI not as an add-on, but as a core payment strategy, position themselves to capture a significant share of digital spend coming from one of the most mobile-native markets globally.

With Merchant of Record models and compliant partners, these companies can achieve this without the cost and complexity of a local entity — potentially turning what once seemed like an “India problem” into a global growth opportunity.

This perspective reflects ongoing work at Transact Bridge, where cross-border payment infrastructure, compliance, and digital commerce converge to enable global companies to scale into India responsibly.